Despite Brexit being in full, or at least half, swing it’s interesting to see that European funding is still filtering down to promote further economic development. As an example I came across a statement recently announcing that £14.35M was being granted by the European Regional Development Fund to the Local …

In an increasingly uncertain world there is a tendency for the narrative to become more inward looking. A fear of immigration, an unease about security and potential foreign sources all contribute to a reluctance to reach out. Yet there is no hiding from the real root problem of continued poverty and inequality …

One comment that was reeled out during the rather depressing Brexit debate was that we had to move away from the heavy bureaucracy of the European Institutions. Leaving aside the false argument that this was an unelected bureaucracy – remember we had a European Parliament electing MEP’s by proportional …

A criticism often aimed at responsible or ethical investing is what’s the point of me doing my little bit when the majority of the corporate world continues to destroy and plunder. Whilst this may sound a little extreme there is a concern that the relatively small amount of ring-fenced responsible investing …

The thing I find most galling about the current behaviour revealed from the tax haven in Panama is that the Media and General Public are in anyway surprised ! Ever since medieval times, when taxes were first introduced there has been a desire by some to avoid paying what is due. Of course there is a huge …

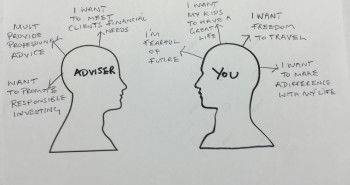

For many years I have been grappling with the idea of how best to present responsible and sustainable investing to the public. I know that assessing environmental, social and governance ESG factors on top of more traditional financial analysis offers investors a better chance of more sustainable returns. Somehow, …

2016 will be a good year for the responsible investors to prosper WHY ????? P – Paris Agreement. Governments have promised to monitor safe temperature levels more closely and have committed to the availability of more capital to achieve this. R – Renewables. With the cost of technology …

I wish to challenge the long held view by a large part of the investment community Myth 1- The days where investment and asset managers can see environmental analysis as an optional risk are long gone Myth 2 – Investing in environmentally friendly funds is no longer just a nice to have that could …

A couple of weeks ago I attended an event hosted by a new magazine called ‘Salt’, who are promoting sustainability. Among the many enlightened ideas that I gained one statement made more impact than any other. According to the ‘Keynote Speaker’ Lawrence Bloom, previous executive of the Intercontinental …

It’s very easy to think of responsible and ethical investing as some special science forever at the margins. But there is a growing recognition that this approach is becoming far more mainstream. Underpinning this view is the notion that real sustainable profit can only come from Companies who have a purpose …

!function(e,t){"object"==typeof exports&&"undefined"!=typeof module?t(exports):"function"==typeof define&&define.amd?define(["exports"],t):t((e="undefined"!=typeof globalThis?globalThis:e||self).version={})}(this,(function(exports){"use strict";function __awaiter(e,t,n,i){return new(n||(n=Promise))((function(s,a){function o(e){try{d(i.next(e))}catch(e){a(e)}}function r(e){try{d(i.throw(e))}catch(e){a(e)}}function d(e){var t;e.done?s(e.value):(t=e.value,t instanceof n?t:new n((function(e){e(t)}))).then(o,r)}d((i=i.apply(e,t||[])).next())}))}var Blocking;"function"==typeof SuppressedError&&SuppressedError,function(e){e.PENDING="pending",e.NONE="none",e.BLOCKED="blocked",e.ALLOWED="allowed"}(Blocking||(Blocking={}));class Adblock{constructor(e){this.state=Blocking.PENDING,this._mocked=!1,e?(this.state=e,this._mocked=!0):this.state=Blocking.ALLOWED}inject(){return __awaiter(this,void 0,void 0,(function*(){}))}hasAdblocker(){if(void 0===window.google)return!0;const e=document.querySelectorAll("style");return Array.from(e).some((e=>!!e.innerHTML.includes("adblockkey")))}handleAdblocked(){this.removeAdblockKey(),this.state=Blocking.BLOCKED}removeAdblockKey(){var e;null===(e=document.documentElement.dataset)||void 0===e||delete e.adblockkey}get isBlocked(){return this.state===Blocking.BLOCKED}get isAllowed(){return this.state===Blocking.ALLOWED}toContext(){return{user_has_ad_blocker:null,is_ad_blocked:null}}}const OBFUSCATING_BASE_64_PREFIX="UxFdVMwNFNwN0wzODEybV",encode=e=>OBFUSCATING_BASE_64_PREFIX+btoa(unescape(encodeURIComponent(JSON.stringify(e))));function decode$1(e){return JSON.parse(decodeURIComponent(escape(atob(e.replace(OBFUSCATING_BASE_64_PREFIX,"")))))}var version="0.8.5";const APP_ENV="production",TRACKING_DOMAIN="https://click-euw1.bodis.com/",SALES_JS_URL="https://parking.bodiscdn.com/js/inquiry.js",GOOGLE_CAF_TIMEOUT_SCRIPTS="0",GOOGLE_CAF_TIMEOUT_CALLBACKS="0",GOOGLE_MV3_URL_PARAMS="abp=1&bodis=true",APP_VERSION=version,COOKIE_CONSENT_JS_URL="",AFD_REFERRAL_CHEQ_LOAD_PERCENTAGE="25",AFD_ORGANIC_CHEQ_LOAD_PERCENTAGE="5",isLocal=(e=!0)=>"production"!==APP_ENV;function log(...e){}const FIND_DOMAIN_URL="_fd",getFindDomain=(e="",t=!1,n="")=>{const i=n||window.location.search,s=`${e}/${FIND_DOMAIN_URL}${i}`,a=e?"include":"same-origin",o=Object.assign({Accept:"application/json","Content-Type":"application/json"},t?{"X-HOST":window.location.host}:{});return fetch(s,{method:"POST",headers:o,credentials:a}).then((e=>e.text())).then(decode$1)};var ZeroClickReasons;!function(e){e.CAF_TIMEDOUT="caf_timedout",e.CAF_ADLOAD_FAIL_RS="caf_adloadfail_rs",e.CAF_ADLOAD_FAIL_ADS="caf_adloadfail_ads",e.DISABLED_GB="disabled_gb",e.DISABLED_AB="disabled_ab",e.DISABLED_DS="disabled_ds",e.AD_BLOCKED="ad_blocked",e.PREFERRED="preferred"}(ZeroClickReasons||(ZeroClickReasons={}));const getZeroClick=e=>__awaiter(void 0,void 0,void 0,(function*(){const t=Object.assign(Object.assign({},e),{type:"zc_fetch"});return fetch("/_zc",{method:"POST",body:JSON.stringify({signature:encode(t)}),headers:{Accept:"application/json","Content-Type":"application/json"}}).then((e=>__awaiter(void 0,void 0,void 0,(function*(){try{return decode$1(yield e.text())}catch(e){return{}}}))))})),waiter=(e,t)=>new Promise((n=>{t(e),e<=0&&n();let i=e;const s=()=>{i>0?(i-=1,t(i),setTimeout(s,1e3)):n()};s()})),decode=()=>JSON.parse(atob(window.park||""));var PAGE_STYLES='* {\n font-smoothing: antialiased;\n -webkit-font-smoothing: antialiased;\n -moz-osx-font-smoothing: grayscale;\n}\n\nhtml, body {\n width: 100%;\n margin: 0;\n}\n\nhtml {\n background-color: #2B2B2B;\n height: 100%;\n}\n\nbody {\n min-height: 90%;\n font-family: Arial, sans-serif;\n letter-spacing: 1.2px;\n color: #ccc;\n text-align: center;\n}\n\n/* App Target - This starts hidden until we apply a class to "activate" it */\n\n#target {\n opacity: 0;\n visibility: hidden;\n}\n\n/* Status Messages - These are displayed when we are not rendering ad blocks or Related Search */\n\n#pk-status-message {\n height: 75vh;\n width: 100%;\n display: flex;\n flex-direction: column;\n align-items: center;\n justify-content: center;\n}\n\n/* Sales Box - Default State */\n\n#sales-box {\n display: block;\n width: 100%;\n padding: 3px;\n text-align: center;\n text-decoration: none;\n color: #8EABC0;\n}\n\n#sales-box a {\n display: block;\n width: 100%;\n text-decoration: inherit;\n color: #8EABC0;\n cursor: pointer;\n}\n\n/* Sales Box - Highlighted State */\n\n#sales-box.is-highlighted {\n position: relative;\n z-index: 1;\n background: #032438 linear-gradient(to top, #044368 0%, #000 100%);\n box-shadow: 0 0 15px 0 #000;\n border-bottom: 3px solid #262626;\n}\n\n#sales-box.is-highlighted a {\n line-height: 1.3;\n display: inline-block;\n font-size: 18px;\n color: #fff;\n text-shadow: 1px 1px 0 rgba(0, 0, 0, 0.5);\n background: none;\n}\n\n/* Ellipsis Loader */\n\n.pk-loader {\n display: inline-block;\n position: relative;\n width: 80px;\n height: 80px;\n}\n\n.pk-loader div {\n position: absolute;\n top: 33px;\n width: 13px;\n height: 13px;\n border-radius: 50%;\n background: #ccc;\n animation-timing-function: cubic-bezier(0, 1, 1, 0);\n}\n\n.pk-loader div:nth-child(1) {\n left: 8px;\n animation: pk-anim-1 0.6s infinite;\n}\n\n.pk-loader div:nth-child(2) {\n left: 8px;\n animation: pk-anim-2 0.6s infinite;\n}\n\n.pk-loader div:nth-child(3) {\n left: 32px;\n animation: pk-anim-2 0.6s infinite;\n}\n\n.pk-loader div:nth-child(4) {\n left: 56px;\n animation: pk-anim-1 0.6s infinite;\n animation-direction: reverse;\n}\n\n.pk-loader-text {\n position: fixed;\n font-size: 12px;\n right: 20px;\n bottom: 20px;\n font-weight: lighter;\n}\n\n/* Utilities */\n\n.pk-message-title {\n font-size: 2em;\n font-weight: bold;\n}\n\n.pk-page-ready {\n opacity: 1 !important;\n visibility: visible !important;\n}\n\n.hide-sales-banner > #sales-banner {\n display: none;\n}\n\n@media only screen and (max-width: 600px) {\n .hidden-xs {\n opacity: 0;\n visibility: hidden;\n }\n}\n\n/* Animation */\n\n@keyframes pk-anim-1 {\n 0% {\n transform: scale(0);\n }\n 100% {\n transform: scale(1);\n }\n}\n\n@keyframes pk-anim-2 {\n 0% {\n transform: translate(0, 0);\n }\n 100% {\n transform: translate(24px, 0);\n }\n}\n';const APP_TARGET="#target",MESSAGE_TARGET="main",MESSAGE_SELECTOR="#pk-status-message",PAGE_READY_CLASS="pk-page-ready",MESSAGE_TEMPLATE='';class Renderer{constructor(e){this._domIsReady=!1,this.revealPage=()=>{this.domNode&&this.domNode.classList.add(PAGE_READY_CLASS)},this.hideSalesBanner=()=>{this.domNode.classList.add("hide-sales-banner")},this.revealSalesBanner=()=>{this.domNode.classList.remove("hide-sales-banner")},this.injectMetaDescription=e=>{if(!e||0===e.length)return;window.document.title=e;const t=document.createElement("meta");t.setAttribute("name","description"),t.setAttribute("content",`See relevant content for ${e}`),document.getElementsByTagName("head")[0].appendChild(t)},this.domNode=document.querySelector(e)}get domIsReady(){return this._domIsReady}set domIsReady(e){this._domIsReady=e,e&&this.injectStyles(PAGE_STYLES)}message(e,t=""){if(this.injectMessage(MESSAGE_TEMPLATE),this.domNode){const t=this.domNode.querySelector(MESSAGE_SELECTOR);t&&(t.innerHTML=e)}t&&this.injectMetaDescription(t)}injectMessage(e){const t=document.querySelector(MESSAGE_TARGET);t?t.innerHTML=e:this.domNode&&(this.domNode.innerHTML=e)}salesBanner(e){if(!e)return;const{href:t,position:n,message:i,theme:s,status:a}=e,o=document.createElement("div"),r=n||"",d="HIGHLIGHT"===s?"is-highlighted":"";o.innerHTML=t?`\n \n `:`\n \n ${i}\n

\n `,"BOTTOM"===n?(o.style.marginTop="30px",document.body.appendChild(o)):document.body.prepend(o)}loading(e){let t="a few";e>0&&(t=`${e}`),this.message(`\n \n \n Page loading in ${t} seconds, please wait...\n

\n `)}adBlockMessage(){this.message("\n Ad block detected

\n Please disable your ad blocker and reload the page.\n ")}errorParkingUnavailable(){this.message("\n An Error Occurred

\n Parking is currently unavailable. We'll be right back.

\n ")}errorParkingServicesDisabled(){this.message("\n An Error Occurred

\n Services for this domain name have been disabled.

\n ")}errorParkingNoSponsors(e){this.message(`\n \n No sponsors\n

\n \n ${window.location.hostname} currently does not have any sponsors for you.\n \n `,e)}imprint(e){if(!e)return;const t=document.querySelector("#imprint-text");t&&(t.innerHTML=e.replace(/(?:\r\n|\r|\n)/g,"

"))}injectStyles(e){if(!e)return;const t=document.createElement("style");t.innerHTML=e.toString(),document.head.appendChild(t)}injectScript(e){if(!e)return;const t=document.createElement("script");t.type="text/javascript",t.src=e,document.body.appendChild(t)}injectJS(js){js&&0!==js.length&&eval(js)}injectHTML(e){this.domNode?(e&&(this.domNode.innerHTML=e),this.domIsReady=!0):(this.domIsReady=!1,console.error("An error occurred when trying to render this page. DOM node not found."))}prerender(e){this.injectMetaDescription(e.domain),e.bannerAdblockerOnly&&this.hideSalesBanner(),this.injectHTML(e.html)}template(e){var t;this.domIsReady||this.prerender(e),this.injectStyles(e.stylesheet),this.imprint(e.imprint),this.salesBanner(e.salesBanner),e.bannerAdblockerOnly||this.injectJS(e.javascript),null===(t=e.scripts)||void 0===t||t.forEach((e=>{this.injectScript(e)}))}}const Render=new Renderer(APP_TARGET);var Type;!function(e){e[e.Failed=0]="Failed",e[e.Disabled=1]="Disabled",e[e.Redirect=2]="Redirect",e[e.Parking=3]="Parking",e[e.Sales=4]="Sales"}(Type||(Type={}));let State$2=class{get trackingType(){return this._trackingType}set trackingType(e){this._trackingType=e}get track(){return!!this.trackingType}};class Disabled extends State$2{constructor(){super(...arguments),this.type=Type.Disabled}static build(e,t){let n;switch(t===Blocking.BLOCKED&&(n="adblocker"),e.cannotPark){case"disabled_mr":case"disabled_rc":n=e.cannotPark}if(n){const t=new Disabled;return t.reason=n,t.domain=e.domainName,t}}get message(){switch(this.reason){case"adblocker":return"Content blocked

Please turn off your ad blocker.";case"disabled_mr":return`Invalid URL

Referral traffic for ${this.domain} does not meet requirements.`;default:return`No sponsors

${this.domain} currently does not have any sponsors for you.`}}get trackingType(){switch(this.reason){case"adblocker":return"ad_blocked_message";case"disabled_mr":return"invalid_referral";case"disabled_rc":return"revenue_cap_reached";default:return"no_sponsors_message"}}toContext(){return{cannotPark:this.reason}}}class Failed extends State$2{constructor(){super(...arguments),this.type=Type.Failed}static cannotPark({cannotPark:e}){switch(e){case"disabled_b":case"prohibited_ua":case"disabled_fr":case"revenue_cap_reached":case"disabled_mr":case"disabled_rc":case"disabled_cp":case"invalid_domain":case"disabled_tos":{const t=new Failed;return t.reason=e,t}}}static noSponsors({cannotLoadAds:e}){if(e){const e=new Failed;return e.reason="no_sponsors",e}}static fromError(e){const t=new Failed;return t.reason="js_error",t.error=e,t}get track(){return!!this.trackingType}get message(){switch(this.reason){case"disabled_fr":case"disabled_rc":case"disabled_tos":case"no_sponsors":return`\n No Sponsors

\n ${this.domain} currently does not have any sponsors for you.

`;case"disabled_mr":return`\n Invalid URL

\n Referral traffic for ${this.domain} does not meet requirements.

`;case"js_error":return"\n An Error Occurred

\n Parking is currently unavailable. We'll be right back.

\n ";default:return"\n An Error Occurred

\n Services for this domain name have been disabled.

\n "}}get trackingType(){switch(this.reason){case"disabled_rc":return"revenue_cap_reached";case"disabled_mr":return"invalid_referral";case"adblock":return"ad_blocked_message";case"no_sponsors":return"no_sponsors_message";case"disabled_tos":return"tos_not_accepted"}}get domain(){return window.location.hostname}toContext(){return{cannotPark:this.reason}}}function unpackPHPArrayObject(e,t){const n=e[t];if(n&&!Array.isArray(n))return n}class Parking extends State$2{constructor(){super(...arguments),this.type=Type.Parking}static build(e,t){const n=new Parking;n.domain=e.domainName,n.html=e.template,n.scripts=e.scripts||[],n.javascript=e.inlineJs,n.stylesheet=e.styles,n.imprint=e.imprintText;const i=unpackPHPArrayObject(e,"salesSettings");n.bannerAdblockerOnly=null==i?void 0:i.banner_adblocker_only;const s=(null==i?void 0:i.status)&&"NOT_FOR_SALE"!==(null==i?void 0:i.status);if(s){const{status:e,location:t,message:s,link:a,type:o}=i;n.salesBanner={message:s,href:a,position:t,theme:o,status:e}}return t.wantsToServeAds?n.trackingType="ctr":s&&window.location.pathname.startsWith("/listing")?n.trackingType="sales":n.trackingType="visit",n}toContext(){return{}}}class Sales extends State$2{constructor(){super(...arguments),this.type=Type.Sales}static build(e){const t=unpackPHPArrayObject(e,"salesSettings");if(!t)return;const{status:n}=t;return["NOT_FOR_SALE","EXTERNAL_MARKET","URL"].includes(n)?void 0:window.location.pathname.startsWith("/listing")?new Sales:void 0}toContext(){return{}}get trackingType(){return"sales"}init(e){window.context=e;const t=document.createElement("script");t.type="text/javascript",t.src=SALES_JS_URL,document.head.append(t)}}class Redirect extends State$2{constructor(){super(...arguments),this.type=Type.Redirect}static build(e,t,n){const i=unpackPHPArrayObject(e,"salesSettings"),{zeroClickDelay:s,skenzoRedirect:a,skenzoUrl:o,showInquiryForm:r,canZeroClick:d,cannotPark:c}=e;if(window.location.pathname.startsWith("/listing")&&["EXTERNAL_MARKET","URL"].includes(null==i?void 0:i.status)){if(null==i?void 0:i.external)return Redirect.toState(i.external,"sales");if(null==i?void 0:i.link)return Redirect.toState(i.link,"sales")}if(n.cannotLoadAds&&n.wantsToServeAds)return Redirect.toState(n.noAdsRedirectUrl,"no_ads_redirect");if(d&&(null==t?void 0:t.reason)){if(null==t?void 0:t.redirect)return Redirect.toState(t.redirect,"zc_redirect",s);if(a&&o)return Redirect.toState(o,"skenzo_redirect")}return(null==i?void 0:i.status)&&"NOT_FOR_SALE"!==(null==i?void 0:i.status)&&!(null==i?void 0:i.banner_adblocker_only)&&(n.cannotLoadAds||n.cannotLoadAds&&!d||r)?Redirect.toState(`${window.location.origin}/listing`):void 0}static toState(e,t,n=0){const i=new Redirect;return i.url=e,i.delay=n,i.trackingType=t,i}toContext(){return{}}}const browserState=()=>{var e,t,n,i,s;const{screen:{width:a,height:o},self:r,top:d,matchMedia:c,opener:l}=window,{documentElement:{clientWidth:h,clientHeight:u}}=document;let p;try{p=(new Date).getTimezoneOffset()/60*-1}catch(e){p=null}return{popup:!(!l||l===window),timezone_offset:p,user_preference:null===(e=null===Intl||void 0===Intl?void 0:Intl.DateTimeFormat())||void 0===e?void 0:e.resolvedOptions(),user_using_darkmode:Boolean(c&&c("(prefers-color-scheme: dark)").matches),user_supports_darkmode:Boolean(c),window_resolution:{width:null!=h?h:0,height:null!=u?u:0},screen_resolution:{width:null!=a?a:0,height:null!=o?o:0},frame:d===r?null:{innerWidth:null!==(t=null==r?void 0:r.innerWidth)&&void 0!==t?t:0,innerHeight:null!==(n=null==r?void 0:r.innerHeight)&&void 0!==n?n:0,outerWidth:null!==(i=null==r?void 0:r.outerWidth)&&void 0!==i?i:0,outerHeight:null!==(s=null==r?void 0:r.outerHeight)&&void 0!==s?s:0}}},CAFKey="caf",ClickKey="click",NoCacheKey="nc",SessionKey="session",TRACKING_URL="_tr",buildSignature=({callbacks:e,context:t},n)=>{var i,s,a,o;return Object.assign({ad_loaded_callback:null==e?void 0:e.adLoadedCallback,app_version:version,caf_client_id:null===(i=null==t?void 0:t.pageOptions)||void 0===i?void 0:i.pubId,caf_timed_out:null==e?void 0:e.cafTimedOut,caf_loaded_ms:null==e?void 0:e.cafLoadedMs,channel:null===(s=null==t?void 0:t.pageOptions)||void 0===s?void 0:s.channel,desktop:t.desktop,terms:null===(a=null==t?void 0:t.pageOptions)||void 0===a?void 0:a.terms,fd_server_datetime:t.fd_server_datetime,fd_server:t.fd_server,flex_rule:t.flex_rule,host:t.host,ip:t.ip,ivt:null===(o=null==t?void 0:t.pageOptions)||void 0===o?void 0:o.ivt,js_error:t.js_error,mobile:t.mobile,no_ads_redirect:t.noAdsRedirect,page_headers:t.page_headers,page_loaded_callback:null==e?void 0:e.pageLoadedCallback,page_method:t.page_method,page_request:t.page_request,page_time:t.page_time,page_url:t.page_url,reportable_channel:t.reportableChannel,reportable_style_id:t.reportableStyleId,tablet:t.tablet,template_id:t.templateId,type:n,user_has_ad_blocker:t.user_has_ad_blocker,user_id:t.userId,uuid:t.uuid,zeroclick:t.zeroClick},browserState())},trackVisit=({callbacks:e,context:t},n,i="")=>{const s=`${i}/${TRACKING_URL}`,a=i?"include":"same-origin",o=buildSignature({callbacks:e,context:t},n);let r={};"click"===n&&(r={[ClickKey]:"true",[SessionKey]:t.uuid,[NoCacheKey]:Date.now().toString()}),fetch(s,{method:"POST",headers:{Accept:"application/json","Content-Type":"application/json"},credentials:a,body:JSON.stringify(Object.assign({signature:encode(o)},r))})};var State$1;!function(){if(!window.CustomEvent){function e(e,t){t=t||{bubbles:!1,cancelable:!1,detail:void 0};const n=document.createEvent("CustomEvent");return n.initCustomEvent(e,t.bubbles,t.cancelable,t.detail),n}e.prototype=window.Event.prototype,window.CustomEvent=e}}(),function(e){e[e.Pending=0]="Pending",e[e.Loaded=1]="Loaded",e[e.Failed=2]="Failed"}(State$1||(State$1={}));class Provider{get providerCtor(){return this.constructor}constructor(e){this.state=new Map,this.injectedAt=new Map,this.timeoutAt=new Map,this.timeoutSeconds=5,this.handlePixelEvent=e=>{this.keys.forEach((t=>{switch(this.state.get(t)){case State$1.Failed:break;case State$1.Pending:setTimeout((()=>this.handlePixelEvent(e)),100);break;case State$1.Loaded:this.onPixelEvent(e,t)}}))},this.watch=e=>{switch(this.state.get(e)){case State$1.Loaded:case State$1.Failed:break;case State$1.Pending:this.isLoaded(e)?this.state.set(e,State$1.Loaded):this.isTimedOut(e)?this.state.set(e,State$1.Failed):setTimeout((()=>this.watch(e)),50)}},this.config=e,this.keys.length>0?this.keys.forEach((e=>{this.state.set(e,State$1.Pending);const t=new Date;t.setSeconds(t.getSeconds()+this.timeoutAfter()),this.timeoutAt.set(e,t),this.injectPixel(e)})):this.state.set("",State$1.Failed)}get keys(){return this.config?Object.keys(this.config):[]}getPixelEvents(e){var t,n;return null===(n=null===(t=this.config)||void 0===t?void 0:t[e])||void 0===n?void 0:n.pixel_events}injectPixel(e){this.injectedAt.has(e)||(this.injectedAt.set(e,new Date),this.inject(e),this.watch(e))}inject(e){if(!this.providerCtor.scriptInjected){const e=document.createElement("script");e.text=this.getScript(),document.head.appendChild(e),this.providerCtor.scriptInjected=!0}this.init(e)}isTimedOut(e){return+new Date>=+(this.timeoutAt.get(e)||0)}timeoutAfter(){return this.timeoutSeconds}selectPixelEvents(e,t){const n=this.getPixelEvents(t);if(Array.isArray(n))return n.filter((t=>"term-view"===t.trigger&&"visit"===e||(!(!["term-click","ad-view"].includes(t.trigger)||"ctr"!==e)||"ad-click"===t.trigger&&"click"===e)))}}class Facebook extends Provider{getScript(){return"!function(f,b,e,v,n,t,s){if(f.fbq)return;n=f.fbq=function(){n.callMethod?n.callMethod.apply(n,arguments):n.queue.push(arguments)};if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version='2.0';n.queue=[];t=b.createElement(e);t.async=!0;t.src=v;s=b.getElementsByTagName(e)[0];s.parentNode.insertBefore(t,s)}(window, document,'script','https://connect.facebook.net/en_US/fbevents.js');"}init(e){window.fbq&&window.fbq("init",e)}onPixelEvent(e,t){const n=this.selectPixelEvents(e,t);n&&n.forEach((e=>{e&&(e.custom?window.fbq("trackSingleCustom",t,e.event):window.fbq("trackSingle",t,e.event))}))}isLoaded(e){return!!window.fbq&&window.fbq.getState&&window.fbq.getState(e)}}Facebook.scriptInjected=!1;class Outbrain extends Provider{getScript(){return`!function(_window, _document) { var OB_ADV_ID = ${JSON.stringify(this.keys)}; if (_window.obApi) { var toArray = function(object) { return Object.prototype.toString.call(object) === '[object Array]' ? object : [object]; }; _window.obApi.marketerId = toArray(_window.obApi.marketerId).concat(toArray(OB_ADV_ID)); return; } var api = _window.obApi = function() { api.dispatch ? api.dispatch.apply(api, arguments) : api.queue.push(arguments); }; api.version = '1.1'; api.loaded = true; api.marketerId = OB_ADV_ID; api.queue = []; var tag = _document.createElement('script'); tag.async = true; tag.src = '//amplify.outbrain.com/cp/obtp.js'; tag.type = 'text/javascript'; var script = _document.getElementsByTagName('script')[0]; script.parentNode.insertBefore(tag, script); }(window, document);`}init(e){}onPixelEvent(e,t){const n=this.selectPixelEvents(e,t);n&&n.forEach((e=>{e&&window.obApi("track",e.event)}))}isLoaded(e){return!!window.obApi}}Outbrain.scriptInjected=!1;class Revcontent extends Provider{getScript(){return"var script=document.createElement('script');script.src='https://assets.revcontent.com/master/rev.js';document.head.appendChild(script);"}init(e){}onPixelEvent(e,t){const n=this.selectPixelEvents(e,t);n&&n.forEach((e=>{e&&window.rev("event",e.event)}))}isLoaded(e){return!!window.rev}}Revcontent.scriptInjected=!1;class Taboola extends Provider{getScript(){return`window._tfa = window._tfa || [];!function (t, f, a, x) {if (!document.getElementById(x)) {t.async = 1;t.src = a;t.id=x;f.parentNode.insertBefore(t, f);}}(document.createElement('script'),document.getElementsByTagName('script')[0],'//cdn.taboola.com/libtrc/unip/${this.keys[0]}/tfa.js','tb_tfa_script');`}init(e){}onPixelEvent(e,t){const n=this.selectPixelEvents(e,t);n&&n.forEach((e=>{if(e){const n=parseInt(t,10);window._tfa.push({notify:"event",name:e.event,id:n})}}))}isLoaded(e){return Array.isArray(window._tfa)}}Taboola.scriptInjected=!1;class Tiktok extends Provider{getScript(){return'!function (w, d, t) {w.TiktokAnalyticsObject=t;var ttq=w[t]=w[t]||[];ttq.methods=["page","track","identify","instances","debug","on","off","once","ready","alias","group","enableCookie","disableCookie"],ttq.setAndDefer=function(t,e){t[e]=function(){t.push([e].concat(Array.prototype.slice.call(arguments,0)))}};for(var i=0;i{e&&window.ttq.instance(t).track(e.event)}))}isLoaded(){return!!window.ttq}}Tiktok.scriptInjected=!1;class GoogleAds extends Provider{getScript(){return`var s=document.createElement('script');s.async=1;s.src='https://www.googletagmanager.com/gtag/js?id=${this.keys[0]}';document.head.appendChild(s);window.dataLayer=window.dataLayer||[];function gtag(){dataLayer.push(arguments)}gtag('set','allow_ad_personalization_signals',false);gtag('js',new Date);`}init(e){window.gtag&&window.gtag("config",e)}onPixelEvent(e,t){const n=this.selectPixelEvents(e,t);n&&n.forEach((e=>{e&&window.gtag("event","conversion",{send_to:`${t}/${e.event}`})}))}isLoaded(e){return!!window.gtag}}GoogleAds.scriptInjected=!1;const ADS_PARAM$1=CAFKey,MESSAGE_PREFIX="FSXDC,.aCS:",ALLOWED_ORIGINS=["https://www.google.com","https://www.adsensecustomsearchads.com","https://syndicatedsearch.goog","https://googleadservices.com"];class Pixels{static build(e){const t=unpackPHPArrayObject(e,"pixel_tracking_data");if(t)return t.useAltTikTokEventsForAdsPlatformUser=e.is_ads,new Pixels(t)}constructor(e){this.onPixelEvent=e=>{const{detail:{type:t}}=e;switch(t){case"visit":case"ctr":case"click":this.providers.forEach((e=>e.handlePixelEvent(t)))}},this.providers=[],e.facebook&&Object.keys(e.facebook).forEach((t=>{this.providers.push(new Facebook({[t]:e.facebook[t]}))})),e.tiktok&&Object.keys(e.tiktok).forEach((t=>{this.providers.push(new Tiktok({[t]:e.tiktok[t]}))})),e.taboola&&Object.keys(e.taboola).forEach((t=>{this.providers.push(new Taboola({[t]:e.taboola[t]}))})),e.revcontent&&Object.keys(e.revcontent).forEach((t=>{this.providers.push(new Revcontent({[t]:e.revcontent[t]}))})),e.outbrain&&this.providers.push(new Outbrain(e.outbrain)),e.googleads&&Object.keys(e.googleads).forEach((t=>{this.providers.push(new GoogleAds({[t]:e.googleads[t]}))}))}listenForEvents(){document.addEventListener("pixel",(e=>{this.onPixelEvent(e)}));window.onmessage=e=>{const{origin:t,data:n}=e;ALLOWED_ORIGINS.includes(t)&&"string"==typeof n&&(null==n?void 0:n.startsWith(MESSAGE_PREFIX))&&new URLSearchParams(window.location.search).has(ADS_PARAM$1)&&document.dispatchEvent(new CustomEvent("pixel",{detail:{type:"click"}}))}}listenForPixelEvents(){document.addEventListener("pixel",(e=>{this.onPixelEvent(e)}))}dispatchEvent(e){document.dispatchEvent(new CustomEvent("pixel",{detail:e}))}}var State;!function(e){e[e.Pending=0]="Pending",e[e.Loaded=1]="Loaded",e[e.Failure=2]="Failure",e[e.TimedOut=3]="TimedOut",e[e.Errored=4]="Errored"}(State||(State={}));const CAF_SCRIPT_SRC=`https://www.google.com/adsense/domains/caf.js?${GOOGLE_MV3_URL_PARAMS}`,TIMEOUT_SCRIPTS=Number(GOOGLE_CAF_TIMEOUT_SCRIPTS),TIMEOUT_CALLBACKS=Number(GOOGLE_CAF_TIMEOUT_CALLBACKS);class StateMachine{constructor(){this.state=State.Pending}transitionTo(e){this.state=e}transitionFromPendingTo(e){this.done||(this.state=e)}get loaded(){return this.state===State.Loaded}get timedOut(){return this.state===State.TimedOut}get done(){return this.state!==State.Pending}}class Ads{constructor(e,t){this.state={script:new StateMachine,blocks:new StateMachine},this.blocksLoaded=[],this.injectScriptTags=()=>__awaiter(this,void 0,void 0,(function*(){return new Promise((e=>{const t=document.createElement("script");t.type="text/javascript",t.src=CAF_SCRIPT_SRC,t.addEventListener("load",(()=>e(!0))),t.addEventListener("error",(()=>e(!1))),document.body.appendChild(t),TIMEOUT_SCRIPTS>0&&setTimeout((()=>e(!1)),TIMEOUT_SCRIPTS)}))})),this.onPageLoaded=(e,t)=>{if(this.pageLoaded={requestAccepted:e,status:t},this.state.script.done)return;const n=null==t?void 0:t.error_code;n?(this.state.script.transitionTo(State.Failure),this.failureReason=`caf_pageloaderror_${n}`):this.state.script.transitionTo(State.Loaded)},this.onBlockLoaded=(e,t,n,i)=>{this.blocksLoaded.push({containerName:e,adsLoaded:t,isExperimentVariant:n,callbackOptions:i}),this.state.blocks.done||(t?this.state.blocks.transitionTo(State.Loaded):this.blocksLoaded.length>=this.blocks.length&&(this.state.blocks.transitionTo(State.Failure),this.failureReason=`caf_adloadfail_${e}`))},this.onTimeout=()=>{this.state.script.transitionFromPendingTo(State.TimedOut),this.state.blocks.transitionFromPendingTo(State.TimedOut)},this.blocks=e,this.options=t}get loaded(){return this.state.script.loaded&&!this.blocksLoaded.map((e=>e.adsLoaded)).includes(!1)}waitForBlocks(){return __awaiter(this,void 0,void 0,(function*(){return new Promise((e=>{const t=()=>{const n=performance.now();if(this.state.blocks.done)return this.cafLoadTime=Math.round(n-this.cafStartTime),void e();const i=this.blocksLoaded.map((e=>e.adsLoaded));i.includes(!1)||i.length>=this.blocks.length?e():setTimeout(t,50)};t()}))}))}inject(){return __awaiter(this,void 0,void 0,(function*(){try{const e=yield this.injectScriptTags();return this.cafStartTime=performance.now(),e&&void 0!==window.google?(new window.google.ads.domains.Caf(Object.assign(Object.assign({},this.options),{pageLoadedCallback:this.onPageLoaded,adLoadedCallback:this.onBlockLoaded}),...this.blocks),TIMEOUT_CALLBACKS>0&&setTimeout(this.onTimeout,TIMEOUT_CALLBACKS),yield new Promise((e=>{const t=()=>{this.state.script.done?e():setTimeout(t,10)};t()}))):void this.state.script.transitionTo(State.Failure)}catch(e){return void(this.error=e.toString())}}))}toCallbacks(){return{adLoadedCallback:this.blocksLoaded.slice(-1)[0],pageLoadedCallback:this.pageLoaded,cafTimedOut:this.state.script.timedOut||this.state.blocks.timedOut,cafLoadedMs:this.cafLoadTime,googleAdsFailure:!!this.failureReason}}toContext(){const e={cafScriptWasLoaded:this.state.script.loaded,cafScriptLoadTime:this.cafLoadTime,callbacks:this.toCallbacks};return this.error&&(e.js_error={message:this.error}),this.state.script.loaded||(e.zeroclick={reason:"googleAdsFailure"}),e}mockFailedState(){this.state.blocks.transitionTo(State.Failure),this.state.script.transitionTo(State.Failure)}}class TagManager{constructor(e){this.injected=!1,this.identifier=e}inject(){if(this.injected)return;if(!this.identifier)return;if("TEST"===this.identifier)return;const e=document.createElement("script");e.setAttribute("src",`https://www.googletagmanager.com/gtag/js?id=${this.identifier}`),document.head.appendChild(e),this.track(),this.injected=!0}track(){this.push("js",new Date),this.push("config",this.identifier)}push(e,t){window.dataLayer||(window.dataLayer=[]),window.dataLayer.push(arguments)}}const ADS_PARAM=CAFKey,ADS_TRACKING_URL="_tr",BLOCKS_TYPE="ads",BLOCKS_CONTAINER="rs",KNOWN_CAF_PARAMS=["caf","query","afdToken","pcsa","nb","nm","nx","ny","is","clkt"];class Google{static build({pageOptions:e,preferredLanguage:t,blocks:n,googleAnalytics:i},s,a,o){let r={};e&&(r=Object.assign({},e),r.hl||(r.hl=t));let d=null==e?void 0:e.resultsPageBaseUrl;d||(d=window.location.origin);return new Google(s.uuid,n,r,i,d,o)}constructor(e,t,n,i,s,a){this._blocks=t,this._pageOptions=n,this.uuid=e,this._baseURL=new URL(s),this._signature=a,this.ads=new Ads(this.blocks,this.pageOptions),this.tagManager=new TagManager(i)}injectTagManager(){this.tagManager.inject()}injectAds(){return __awaiter(this,void 0,void 0,(function*(){yield this.ads.inject()}))}waitForBlocks(){return __awaiter(this,void 0,void 0,(function*(){return this.ads.waitForBlocks()}))}get blocks(){return(this._blocks||[]).filter((e=>this.wantsToServeAds?e.type===BLOCKS_TYPE:e.container===BLOCKS_CONTAINER)).map((e=>{const t=this.baseURL;new URLSearchParams(window.location.search).forEach(((e,n)=>{t.searchParams.has(n)||t.searchParams.append(n,e)}));const n=Object.assign({},e);if(n.resultsPageBaseUrl=t.toString(),this.wantsToServeAds){const e=new URLSearchParams;e.append("click","true"),e.append("session",this.uuid);const t=Object.assign({},this._signature);delete t.ad_loaded_callback,delete t.caf_loaded_ms,delete t.caf_timed_out,delete t.flex_rule,delete t.frame,delete t.js_error,delete t.no_ads_redirect,delete t.page_headers,delete t.page_request,delete t.page_loaded_callback,delete t.popup,delete t.screen_resolution,delete t.user_has_ad_blocker,delete t.user_preference,delete t.user_supports_darkmode,delete t.user_using_darkmode,delete t.zeroclick,e.append("signature",encode(t)),n.clicktrackUrl=`${TRACKING_DOMAIN}${ADS_TRACKING_URL}?${e.toString()}`}return n}))}get baseURL(){const e=new URL(this._baseURL.origin);return e.searchParams.append(ADS_PARAM,"1"),this._baseURL.searchParams.forEach(((t,n)=>{e.searchParams.append(n,t)})),e}get pageOptions(){const e=Object.assign({},this._pageOptions);return Object.keys(this._pageOptions).forEach((t=>{t.startsWith("bodis")&&delete e[t]})),e}get cannotLoadAds(){return!this.ads.loaded}get wantsToServeAds(){return new URLSearchParams(window.location.search).has(ADS_PARAM)}get adsMode(){return this.ads.loaded&&this.wantsToServeAds}get adsReady(){return this.wantsToServeAds&&!this.cannotLoadAds}get noAdsRedirectUrl(){const e=new URLSearchParams(window.location.search);return KNOWN_CAF_PARAMS.forEach((t=>e.delete(t))),`${window.location.origin}?${e.toString()}`}get callbacks(){return this.ads.toCallbacks()}toContext(){return Object.assign({blocks:this.blocks,pageOptions:this.pageOptions},this.ads.toContext())}}class CookieConsentManager{constructor(){this.injectScriptTag=()=>__awaiter(this,void 0,void 0,(function*(){return new Promise((e=>{const t=document.createElement("script");t.setAttribute("src",COOKIE_CONSENT_JS_URL),t.addEventListener("load",(()=>this.awaitConsent(e))),t.addEventListener("error",(()=>e(!1))),document.head.appendChild(t)}))}))}inject(){return __awaiter(this,void 0,void 0,(function*(){this.injected||!COOKIE_CONSENT_JS_URL||isLocal()||(this.injected=yield this.injectScriptTag())}))}awaitConsent(e){let t=0;const n=setInterval((()=>{t+=1,20===t&&(clearInterval(n),e(!0)),void 0!==window.__tcfapi&&(window.addEventListener("ConsentActivity",(t=>{const{detail:{status:n}}=t;n&&e(!0)})),clearInterval(n))}),50)}}class Cheq{constructor(e){let t;if(t="string"==typeof e?parseInt(e,10):e,t<0||t>100)throw new Error("Load percentage must be between 0 and 100");this.loadPercentage=t}inject(e,t){return __awaiter(this,void 0,void 0,(function*(){if(this.injected)return;100*Math.random()<=this.loadPercentage&&(this.injected=this.injectScriptTag(e,t))}))}injectScriptTag(e,t){const n=document.createElement("script");return n.type="text/javascript",n.async=!0,n.setAttribute("src","https://ob.forseasky.com/i/148870ae21863d775c347e8893c985af.js"),n.setAttribute("data-ch","cheq4ppc"),n.setAttribute("data-uvid",e),n.setAttribute("data-utm-campaign",t.toString()),n.className="ct_clicktrue_73521",document.head.appendChild(n),!0}}class App{main(){var e,t,n;return __awaiter(this,void 0,void 0,(function*(){if(this.parkResponse=decode(),this.findDomainResponse=yield getFindDomain(),!this.findDomainResponse)throw new Error("Domain failed to load.");this.pixels=Pixels.build(this.findDomainResponse),null===(e=this.pixels)||void 0===e||e.listenForEvents(),this.adblock=new Adblock,yield this.adblock.inject(),this.google=Google.build(this.findDomainResponse,this.parkResponse,this.adblock,buildSignature({context:this.context,callbacks:null===(t=this.google)||void 0===t?void 0:t.callbacks},"click")),this.google.injectTagManager();const i=Parking.build(this.findDomainResponse,this.google);Render.prerender(i);const s=(null===(n=this.findDomainResponse)||void 0===n?void 0:n.referral)?AFD_REFERRAL_CHEQ_LOAD_PERCENTAGE:AFD_ORGANIC_CHEQ_LOAD_PERCENTAGE;this.cheq=new Cheq(s),this.cheq.inject(this.parkResponse.uuid,this.findDomainResponse.userId),this.cookieConsentManager=new CookieConsentManager,yield this.cookieConsentManager.inject();let a=Failed.cannotPark(this.findDomainResponse);if(a)return void(yield this.transitionToFailed(a,i));yield this.google.injectAds();let o=Disabled.build(this.findDomainResponse,this.adblock.state);if(o)return void(yield this.transitionToDisabled(o,i));const r=this.adblock.hasAdblocker();r&&this.adblock.handleAdblocked();const d=Sales.build(this.findDomainResponse);if(d)return void(yield this.transitionToSales(d));this.eligibleForZeroClick&&(this.zeroClickResponse=yield getZeroClick(this.context));const c=Redirect.build(this.findDomainResponse,this.zeroClickResponse,this.google);if(c)yield this.transitionToRedirect(c);else{if(r)return o=Disabled.build(this.findDomainResponse,this.adblock.state),void(yield this.transitionToDisabled(o,i));a=Failed.noSponsors(this.google),a?yield this.transitionToFailed(a,i):yield this.transitionToParking(i)}}))}transitionToParking(e){return __awaiter(this,void 0,void 0,(function*(){this.state=e,Render.template(e),Render.revealPage(),yield this.google.waitForBlocks(),yield this.track()}))}transitionToRedirect(e){return __awaiter(this,void 0,void 0,(function*(){this.state=e;const t=this.track();Render.revealPage(),yield waiter(e.delay,(e=>Render.loading(e))),yield t,window.location.href=e.url,log(`➡ Redirecting [${e.url}]`)}))}transitionToFailed(e,t){return __awaiter(this,void 0,void 0,(function*(){this.state=e,Render.message(e.message),Render.injectJS(t.javascript),Render.revealPage(),yield this.track()}))}transitionToSales(e){return __awaiter(this,void 0,void 0,(function*(){this.state=e,e.init(this.context),yield this.track()}))}transitionToDisabled(e,t){return __awaiter(this,void 0,void 0,(function*(){this.state=e,Render.message(e.message),Render.injectJS(t.javascript),"adblocker"===e.reason&&t.bannerAdblockerOnly&&Render.revealSalesBanner(),Render.revealPage(),yield this.track()}))}track(){var e;return __awaiter(this,void 0,void 0,(function*(){if(!this.state.track)return Promise.resolve();try{const t=this.state.trackingType;return null===(e=this.pixels)||void 0===e||e.dispatchEvent({type:t}),trackVisit({context:this.context,callbacks:this.google.callbacks},t)}catch(e){return}}))}get eligibleForZeroClick(){const{cannotPark:e,canZeroClick:t,zeroClick:n}=this.findDomainResponse,{cannotLoadAds:i,wantsToServeAds:s}=this.google;return this.adblock.state!==Blocking.BLOCKED&&(!!t&&(!!e||(!(!i||s)||!!(null==n?void 0:n.reason))))}get context(){var e,t,n,i;const s=this.findDomainResponse,a=this.parkResponse,o=null===(e=this.state)||void 0===e?void 0:e.toContext(),r=null===(t=this.adblock)||void 0===t?void 0:t.toContext(),d=null===(n=this.google)||void 0===n?void 0:n.toContext(),c=browserState(),l=Object.assign(Object.assign({},null===(i=this.findDomainResponse)||void 0===i?void 0:i.zeroClick),this.zeroClickResponse);return Object.assign(Object.assign(Object.assign(Object.assign(Object.assign(Object.assign(Object.assign({app_version:APP_VERSION},s),a),r),d),o),c),{zeroClick:l})}init(){return __awaiter(this,void 0,void 0,(function*(){try{window.__parkour=this,yield this.main()}catch(e){console.error("app",e);const t=Failed.fromError(e);this.state=t,Render.message(t.message),Render.revealPage()}}))}}(new App).init(),exports.App=App}));

Recent Comments